13.1 On our walk through the office, we joined a group of visitors who were talking to The Partnership�s accountant. He was explaining the accounting methods and practices that he had developed for the partners and how he came to join them.

13.2 "I was a consultant to The Partnership for many years prior to becoming a partner," said the accountant, "so it wasn�t really a big change in my working life. Why did I join? There were a number of reasons. As I worked for the partners I began to identify more and more with their goals. I began to see the possibilities of a new way of life for my family and myself. I had an increasing awareness of The Partnership as being applied Christianity, and I wanted the security that The Partnership offered, and the extra money too of course. I developed more and deeper Christian commitments and there came a time when there was no other place for me to go except here. As a consultant to conventional proprietary companies my Christian principles started to stop me from breaking or bending rules, safely you understand, in favour of my clients. I began to dimly see that there is more that can be achieved from a lifetime of work than merely the accumulation of a certain amount of limited-value capital."

13.3 "Have you developed any exciting accounting techniques?" quipped one of the visitors.

13.4 The accountant answered flatly. "In response to the need for a set of accounts that are both current and reflect the true state of The Partnership, I believe, in collaboration with other partners, I have."

13.5 "One of The Partnership�s peculiar problems is associated with its capital account. As you may know from the Rules - Rule 2 and Figure 1 - incoming partners are required to pay their part of the net capital worth, and outgoing partners are entitled and required to receive theirs. This means that an accurate set of capital accounts has to be kept if equity is to be maintained. My initial brief from the partners when I was auditor was to accurately evaluate the net capital worth of The Partnership every year. This is still done by The Partnership�s auditor every year, and the partners are still vitally interested in the accuracy of his work. The partners want to know the truth, not some book figure for tax purposes - they don�t want to know some fictitious written-down book-value for a piece of capital plant, they want to know its current market value! This is a major difference from outside firms: The Partnership does not in general depreciate to the extent allowed by the law since this would very soon require the keeping of a shadow set of books showing the real value of capital assets. It was decided to depreciate only to an extent considered accurate, and to keep only one set of books."

13.6 "Another significant difference I found with The Partnership was that I was required to make accounts intelligible to the partners. This contrasted markedly with my other outside work where the aim was often to suppress data to do with controversial aspects of the enterprise by submerging it in overall figures, thereby avoiding accountability to the rank and file shareholders."

13.7 "So The Partnership has required significant changes in conventional accounting techniques because they need current, accurate, intelligible information continuously available to all the partners. Are there any other significant areas of difference?" I asked.

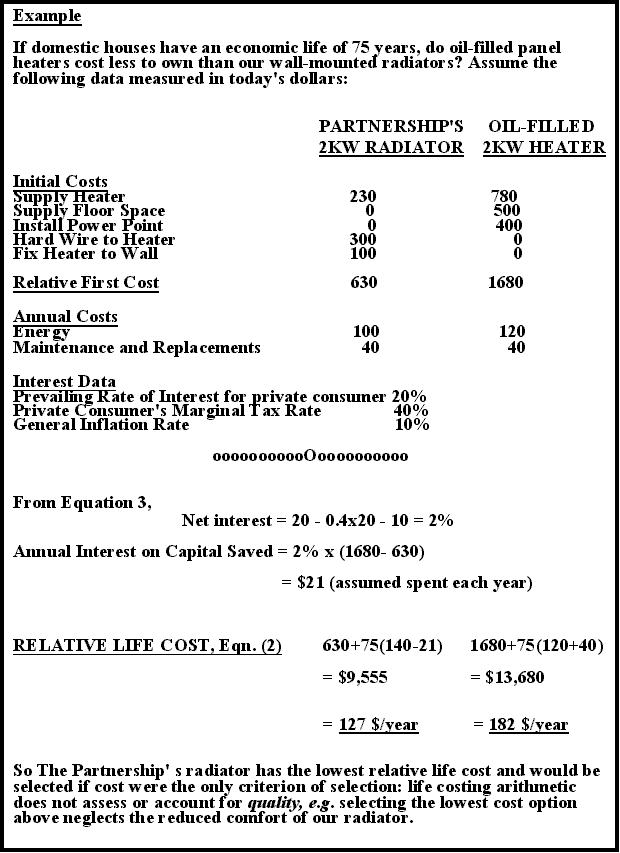

13.8 "Yes, there is," replied the accountant. "As you know, competition is fierce in commodities and fortunes are made or lost on marginal differences in product cost or quality. The partners recognised that there was a need for an easily understood method for the long-run pricing of alternative options that accounted for inflation and taxation, so that consumers could be properly informed as to the best value for money measured by the lowest cost per year of life. Three of us worked on the problem: the engineer, the economist and myself. We developed a very simple method for life costing that is sufficiently accurate for The Partnership to make relevant decisions accordingly. It is suitable for life costing a commodity or its components and for determining relative life costs of competing products or services."

13.9 "The method is general and can be applied to the life costing of any commodity, with an accuracy usually limited only by the accuracy of the assumptions. We were asked to develop accurate, easily understood methods using mathematical models that mimicked as closely as possible human behaviour in the market place. The traditional mortgage-type equations used in the banking and insurance industries are difficult to understand and use, even though they may approximate the behaviour of a person being sold a mortgage or an insurance policy quite safely from the viewpoint of a bank or insurance company."

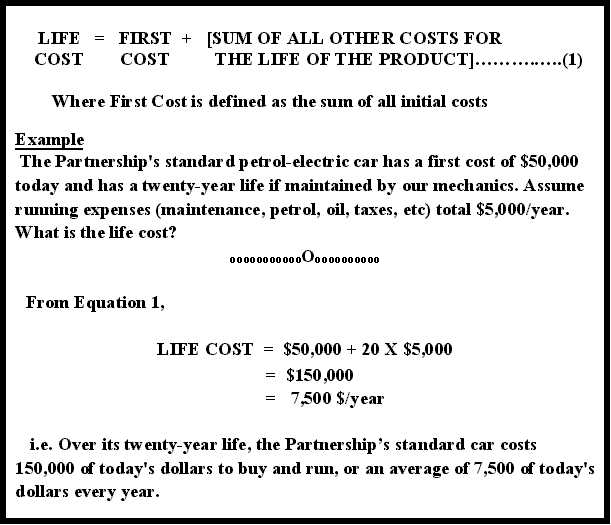

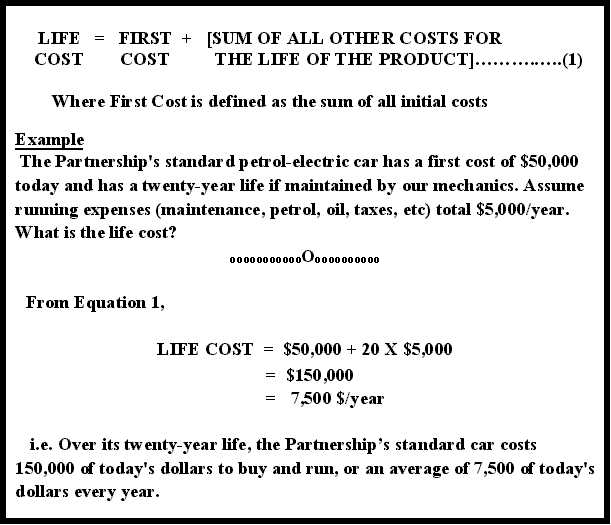

13.10 "Because inflation is high, the first concept to grasp is that of working in constant prices: the dollar value of a product can be viewed as a measure of that product, but the same dollars must be consistently used when pricing the options. It is invalid to mix dollars from one time with dollars from another time. When all measurements are made in dollars at a given time, we are working in constant prices in the sense that time is held still - the general rate of inflation has therefore been accounted for. All options must be priced in dollars at the time of pricing, and future expenditure such as maintenance is measured in current known prices. Putting this in the form of an equation where all terms are measured in today�s dollars, look at the first simple example on the chart."

13.12 "Owners of a product usually pay for its maintenance out of their income as they earn it. Since maintenance money is spent as it is earned it cannot be put in an interest bearing account, hence the simple summation in Equation 1."

13.13 "That wasn't hard, was it?" coaxed the accountant. "Are you ready for the next concept? Concepts are difficult for most adults to absorb, but there are only two basic concepts in this treatment of life costing: constant pricing and relative costs. Once you have a grasp of the fundamental equations that represent these concepts, you will have no difficulty with the arithmetic. Are there any questions?"

13.14 The economist contributed: "Perhaps you should explain the way the partners instructed us to define the terms cost and life cost so that there would be no misunderstanding among any of us."

13.15 "We were instructed," explained the accountant, "to use these terms with their commonly accepted meanings. The cost of a commodity is understood by the partners to mean the initial cash that has to leave their hands to purchase it; the life cost of a commodity is the amount of cash measured in today�s dollars that has to be paid out over the life of the commodity to own and use it - this includes all initial costs, maintenance, energy to run and, if we need to compare options and one option is dearer than another, an interest component."

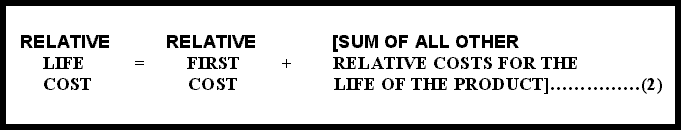

13.16 "The concept of relative life cost has to be introduced since we often want to know which of several options is cheapest in the long term relative to the other options. Also, if several competitive products are identifiable as components of a larger product or system, then it is important to reflect all the significant factors affecting the system as a whole into the commodity costs which then become relative costs only. For example, The Partnership makes a low-cost wall-mounted radiator, and if it is compared to the more luxurious oil-filled panel heater the floor space occupied by the panel heater must be accounted for. To adequately determine relative life costs for a commodity to be purchased by a person or enterprise means accounting for the combined effects of taxation and inflation."

13.17 "Extending Equation 1 to include relative costs produces Equation 2 on the chart."

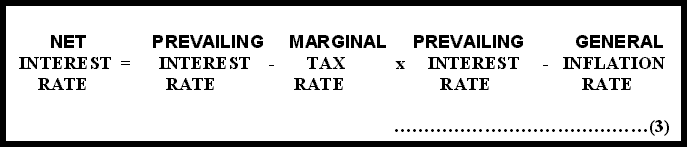

13.18 "If a consumer has just enough cash to buy the dearest of two options, then if the cheaper option is chosen the money saved can become capital if it is invested at the prevailing rate of interest. The prevailing rate of interest varies with the amount available to invest, the degree of security required, and the amount of work the consumer is able or willing to do with the capital. The interest earned on this capital will be taxed at, for the purposes of life costing, the consumer�s marginal rate of tax. The net interest rate will be further reduced by the general rate of inflation. On the chart, this is expressed approximately by Equation 3. The capital itself will also be eroded by the general inflation rate."

13.20 "The best way to learn life costing is to do examples," said the accountant. "Work through the example on the wall-chart."

13.22 "Notice the comment at the bottom of the chart regarding quality. The quality of a heating system consisting of individually thermostatically controlled electrically powered oil-filled panel heaters is superior to a similar number of The Partnership�s radiators, since slow heating by non-fan natural convection is more comfortable than radiant heat. Life costing is only a way of bringing the costs of competing options to parity. The buyer/consumer still has to identify and evaluate the quality factors. For example, a consumer may decide to pay more for a panel heating system rather than tolerate less comfort with our radiators whereas a buyer may not. Whole new ranges of problems arise if the buyer is not the consumer - far beyond the scope of this discussion of life costing basics."

13.23 "Relative costs had to be used in this example since the options being evaluated (heaters) were recognised as being part of a larger product (house). It would not have been equitable to consider just the costs of the heaters alone since highly relevant factors such as relative floor space consumed do not appear in the heater costs. These costs have to be estimated and added to bring the options to parity. Choosing the panel heater commits the consumer to expenses that are not obvious: a slightly bigger house if living space is maintained and no interest on money saved. The art in life costing is to recognise the significant factors - failing to recognise the significant factors leads to gross errors and bad decisions."

13.24 "This example illustrates the general criterion of selection which I have called 4."

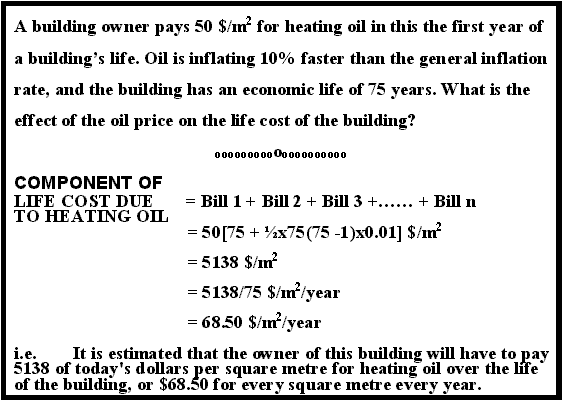

13.26 "The last concept is the treatment of commodity prices that are known to be inflating faster than the general inflation rate. This concept is not needed for most of the decisions that consumers have to make. If decisions were made only on the basis of Equations 1 to 3 and the criterion 4 with all the significant factors being accounted for, a reasonable accuracy in the data, and sensible interpretation of the results by the person making the decision in full knowledge of the assumptions and accuracy of data, then many more decisions would be soundly based and cost-effective."

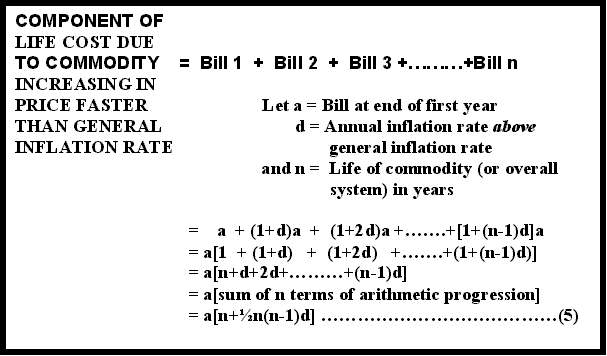

13.27 "There are however some cases where it is known that the price of a significant factor is increasing much faster than the general inflation rate, and the accuracy of the result would be intolerable if this were neglected. The effect on life costs appears in the annual expenses component and, for the same reasons as given in establishing Equations 1 to 3, this money is spent as it is earned and does not attract interest. People meeting this type of expense have to pay ever-increasing bills even if the general inflation rate is nil. At constant prices, this is shown as Equation 5."

13.29 "Finally, an example to illustrate the use of Equation 5."

From The Partnership, by Graeme Doel.

Converted to HTML by Simon Grant, 2003.