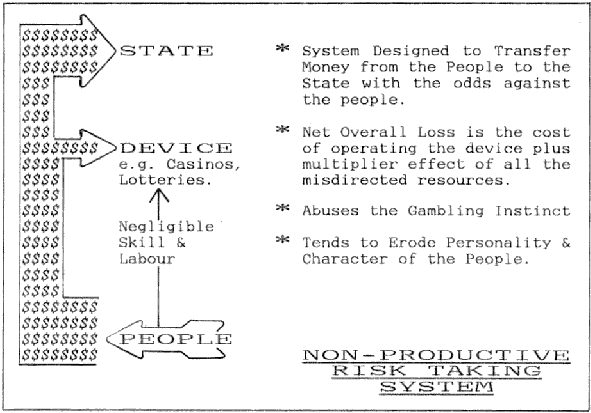

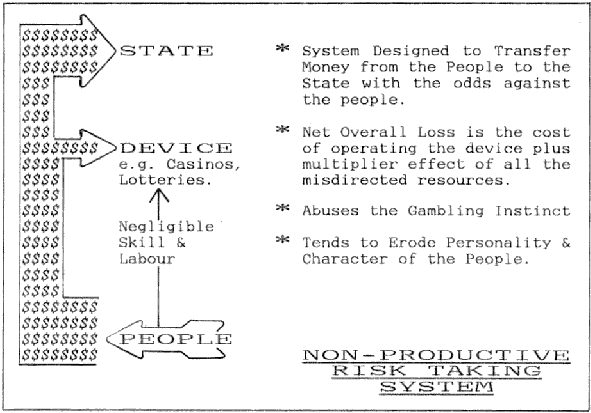

12.1 We arrived in time for part of the economist’s lecture to a small band of interested partners. He was saying: "In the nineteenth and early twentieth century, people conducted private lotteries and gambling devices from which the State got little or nothing. The State wanted more of this money for nothing, and started taxing and then running gambling devices. Now the position is reversed: the State monopolise the devices, aided and abetted by the police, and has become the chief exploiter in the search for easy money. This is shown in the first slide:

12.3 "Non-productive risk-taking systems," said the economist,"are characterised by a negligible skill and a disproportionately large money flow from the people, the exploitation of one or more of the human weaknesses, and the use of random rewards. Examples are slot machines, pools and lotteries. A further characteristic of this type of system and its non-productive nature is that if the people and the State’s servants are viewed as a group, there is always a significant net overall loss or waste of resources - the people lose money plus the time involved in operating the device, the State loses all the time and effort used to build and operate the ‘business’ plus the increased cost of ‘rehabilitative’ services required consequently, and there exists overall a no-win situation. Underpinning all of these devices is that the odds are always stacked against the people by some means, often predictably mechanical. These devices should be avoided in favour of more productive risk-taking ventures".

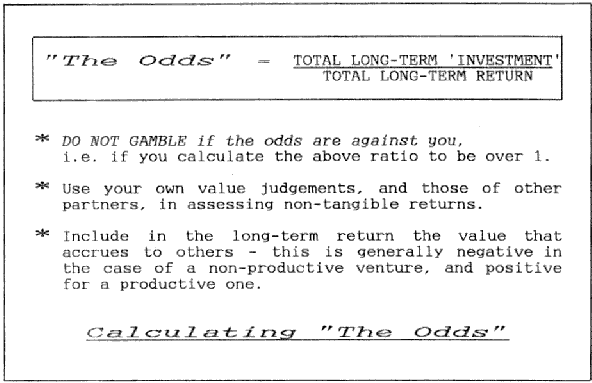

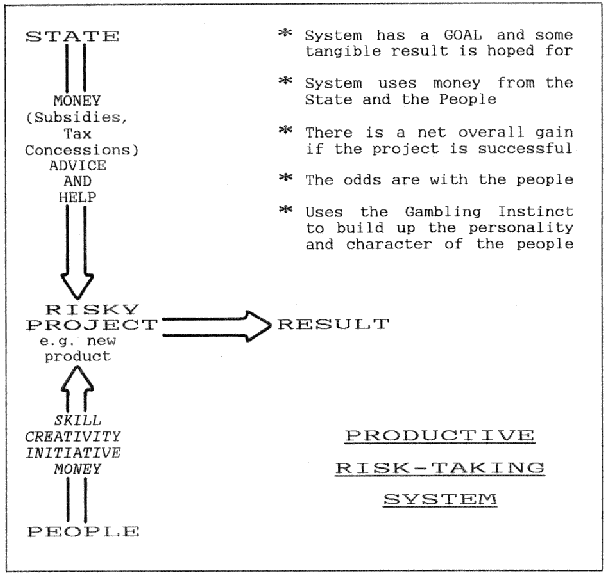

12.4 The economist projected his next slide:

12.5 "Usually it is not difficult to calculate if the odds are in your favour or not," the economist explained. "For example, if a person wishes to sell you a raffle ticket: add up the total ‘investment’ if you bought all the tickets, say $1,000; estimate the total value of the prizes, say $500; the odds are therefore against you, 2, and you should not gamble."

12.6 "I have presented the odds from the State’s perspective and argued implicitly that a profit for the supplier/promoter is a loss for the consumer. Thus if the odds are in favour of the promoter/State they are greater than one, which is precisely the condition when the consumer of a device should not co-operate by using it. Consumers are treated collectively - in general what is bad for them collectively is bad for them individually. Practising the above would eradicate one of the worst aspects of State-run devices where a few benefit at the expense of many of their fellows."

12.7 "There are two classes of people according to how they get their income: one class develops their skills, husbands their capital, and puts a fair share of their resources at the service of others to earn their income; the second class gets money by exploiting the weaknesses of people thereby thrusting them into a form of bondage - these are the parasites in the society."

12.8 "Surely," I said, "if people want to spend their money on devices such as lotteries, even if the odds are against them, they should be allowed to in a democratic society?"

12.9 "The point you make is as old as money, and it has usually been made most forcefully by the people with the money in an effort to retain their position or income. The partners do not accept it and have specifically written into the Rules that they shall forever be in the first class. Rule 58 requires the board to ensure that The Partnership does not engage in any business that exploits the human weaknesses, and the board has consequently taken decisions to keep out of businesses associated with addictive drinks, including those containing alcohol, slot machines that randomly repay money rather than regularly eject goods, lotteries, raffles and similar businesses. Jesus healed peoples’ weaknesses, he didn’t exploit them for his gain - he would not allow the temple to be used for exploiting people via the exchange process and said in Matthew 21: 13, "... you have made it a den of thieves." The Partnership is Christian, and the board is constantly on the alert to discharge this responsibility."

12.10 "It is much easier to get money by exploiting weaknesses than by earning honestly. It is hard to always be at the service of consumers who can freely choose between competing makers. If our cost/quality ratios fell below competitors’, we would quickly feel the feedback in lost orders."

12.11 "The twentieth century slot machine that randomly returned money is a good example of the parasitic income class. A human weakness was discovered: many people would habitually put money into these machines. Led by criminal elements, the State exploited this weakness and took money from people for nothing via these devices. Perhaps they would still be in our society had it not been for a referendum about fifty years ago that was given prior force of law. Slot machines were so deeply embedded that their makers and users all assumed that the people really wanted them, but the results called for their removal. The removal proved difficult and painful - like the removal of an advanced malignant cancer. But it was done, and this form of exploitation and oppression is no longer with us - although there will always be strong pressure for their return from people who stand to get a lot of money from their reintroduction."

12.12 "Now contrast the productive risk-taking venture," said the economist, "which is characterised by a considerable outflow of skill, creativity and initiative from the people together with a proportional money outflow. The strengths of the people are used rather than their weaknesses exploited, and resources are mobilised to achieve a predetermined tangible goal. Further characteristics are the provision of money by the State - at least in the initial stages before the goal is achieved - rather than to the State, and a net overall gain to all concerned if the risk taken achieves the desired result. For the above reasons, productive risk-taking is preferred to non-productive risk-taking if there is any surplus available for either. Compare this slide for a productive risk-taking system to the non-productive system."

12.14 "We know from experience that those people who habitually take risks where the odds are in their favour - that is, co-operate in productive ventures - develop their characters, achieve more of their potential and enhance their personalities. It is difficult to be objective in these observations since changes take place over a long time to people we get to know well and no control or experimental groups have been set up, but there is among this class of risk-taker a verve and vitality - a charisma if you like - that is absent in the general population to the same extent."

12.15 We were glad we caught the end of the economist’s lecture and waited until the partners left before introducing ourselves and asking a few questions. "That was a rather unconventional lecture," I said. "It would hardly be condoned in State schools for inclusion in any standard syllabus."

12.16 "Unfortunately, you are right," said the economist, "although the discipline, attention span and interest level in State schools is so bad that I doubt if anyone would take any notice. During the last 175 years, Christians have gradually been forced out of State schools to Christian schools and anti-Christian forces now have control of the State system. People have become so used to being exploited that they often don’t even know when it’s happening to them. That’s why we have these rather elementary lectures for the partners - to keep them informed, aware and alert to the exploitative devices that surround them and to enable them, for example, to discriminate between a risk that should obviously be taken and one that should obviously not be taken."

12.17 "What happens in hard times?" I asked. "It is all very well to have a lot of happy people when there is plenty of profit - I mean surplus - but does group cohesion fly out the window when poverty comes in the door?"

12.18 "We suffer like everyone else during hard times, but perhaps to a lesser extent. There is a mechanism laid down in the Rules to cope with declining surplus: normally the surplus is positive and it is divided equally among the partners; when the surplus declines to zero partners still receive their normal drawings but there is clearly no surplus to distribute; when the surplus goes slightly negative the people on the highest drawings take less until, if necessary, all partners receive the minimum drawings; when the surplus goes even further negative, gifts and loans are relied upon; if this is still not enough to keep The Partnership liquid, we have to face the winding up of our enterprise."

12.19 "That’s the official mechanism," continued the economist. "In practice there are quite a few devices used that the average bread-winner in the nuclear family does not have. There have been price wars, for example, and we have had to have the financial strength to survive - we have no choice but to accept the ruling outside price for the commodity in trouble. When the selling price goes less than the cost of production, we limit the supply, stockpile, and write off the loss due to that commodity against more profitable ones. The partners pay the cost of production irrespective of the outside price."

12.20 "In the rare instances when there is a general fall in prices, that is a recession, there is a decline in surplus and the mechanism outlined above is used to accommodate this. In such times we have found an increase in group cohesion - I think perhaps because the partners realise that The Partnership is the only thing that stands between them and the position that their neighbours outside are facing. At least at such times the partners benefit from the policy of being their own captive market: the outside demand can only disappear, and the loyalty of the partners results in an increasing internal demand. I think some of the richer partners actually must stockpile The Partnership’s consumer durables at such times. This was one of the motives for setting up the farm: in hard times the partners will not starve, even if their diet may be a little less diversified."

12.21 "You should have heard the discussion on money management at the co-operative and personal levels," said the economist.

12.22 "At the co-operative level The Partnership has a policy of cash trading which has been formalised in Rule 58. Our solicitor knows the history of this rule, if you’re interested you can attend his lecture, but from the applied point of view this rule has dramatic consequences and marks us off from the general business community. The idea of allowing the partners to be exploited by percentage people - people who get an income by adding a percentage to the products of other peoples’ labour somewhere in the exchange process - is not very well received in The Partnership. So this rule implies a refusal to pay the administrative and interest charges associated with credit."

12.23 "At the personal level, and this is usually of considerable interest to visitors and new partners, every encouragement is given by The Partnership to ensure that the partners know how to manage their personal assets both real and liquid in their best interests. In order to combat the pressured advertising of readily available high-priced money, The Partnership has developed the following weaponry:

12.27 "Now this seems a paltry armoury with which to fight the ingrained attitudes and mass marketing techniques that have developed outside, but as new partners start to appreciate that the sum of the little benefits that accrue to them as partners adds up to a significant change in life-style, they realise that outside norms are not ours."

12.28 "Decentralisation is a feature of the partnership form of organisation," continued the economist. "The problem with decentralisation is that it benefits in social terms, not money, the people who have moved out of the less attractive highly congested areas to the more attractive and desirable areas. Usually the industry that moves out of a centralised area pays more for freight, telephone, postage and distance-dependent items. This reduces profit and is unattractive to existing private industry."

12.29 "Suppose a privately owned manufacturing company is seriously considering decentralising: the owners have control of the business and ultimately take the decision - they are likely to be middle-aged with choice homes in choice localities, and they are able to adjust their travelling times away from peak traffic times. Add to this the fact that decentralising costs money and you will see that there is quite obviously insufficient incentive for the people who have control of the industry to decentralise it. The incentive to relocate resides with the people who have no control - the employees. The only solution therefore is for the people with the incentive to jointly mobilise their resources and convert a portion of those resources to capital with which to earn income in a decentralised location thereby improving their quality of life. This improvement is obtained at the expense of increased surplus that would in general accrue if they established themselves in an urban environment."

12.30 "Thus one of the strengths of the extended partnership form is that it encourages decentralisation by putting the power to decentralise into the hands of the people who have the incentive to decentralise. If you want to move out of the city, then you have to combine with a like-minded group of people in order to mobilise the necessary capital and skills required to get an income in a decentralised location."

12.31 "There was before the board today an excellent example of how The Partnership assists decentralisation: a splinter-group wants to buy and run autonomously The Partnership’s farm. The board approved their proposal and now this group of city people with co-operative industrial training and skills will move to a country town."

12.32 "Yes," I said, "I sat in on that meeting as an observer."

12.33 "Then you will understand something of what I am saying to you," said the economist. "This group will add to the life and vitality of that town their labour, their capital and their Spirit. When I look at the concrete boxes devoid of character and charm that is the response of society to the unsolved housing problem, when I hear the unspoken goal of the city masses ‘A Place to Live!,’ when I see the need to develop a community spirit where noise and pollution do not dull the senses and where people do not have to devote to commuting the time that belongs to their families - I realise how important it is to decentralise. It is really only the extended partnerships that during last century have achieved any significant decentralisation of manufacturing industry. The Partnership gives hope to the people for by the use of it they can take back control of their environment and their destiny."

12.34 "It is an attitude that the partners have developed whereby they do not require unlimited potential profits and unlimited material possibilities. They are prepared to accept from the outset when they first become partners the prospect of strictly limited incomes for the rest of their lives. This ‘sacrifice’ is necessary for industrial justice, and is no sacrifice at all for the vast majority of people who would never achieve great wealth anyway."

12.35 "Don’t you ever get tired of giving to the church whenever the board says so?" I asked.

12.36 "There is no appropriation for the State, social services or the church from the surplus prior to its distribution except as provided under the 10% Rule 65," answered the economist. "If any of these bodies wants money additional to that which may have been given under the 10% rule, they have to approach each individual partner. The Partnership aims to produce sufficient for a comfortable existence and when this is achieved for each partner there has to be good reason to make more strenuous exertions. Individual partners may be led by the Spirit to work harder for a larger income in order to contribute more to higher, altruistic goals. Some outside organisations have found it possible to align their goals with The Partnership’s and thereby gain board approval for a particular project."

12.37 "Until outsiders get to know us, they perceive us a highly efficient capitalist enterprise. It takes time for people to appreciate our differences. There’s a social gain in trading with people: you get to know them and they get to know you; you have something in common - that which is traded. And there is still a joy in rendering service if it isn’t marred by manipulation and exploitation. Even outside the joy of service still glimmers through the fog of lies, corruption, manipulation and double-dealing that intervenes in the name of profit making between manufacturer and consumer. The Christian enterprise has a duty to participate in the normal workings of society to show a lead, to be the leaven in the loaf of non-Christian enterprises, and to demonstrate the heights that ordinary people can aspire to and achieve."

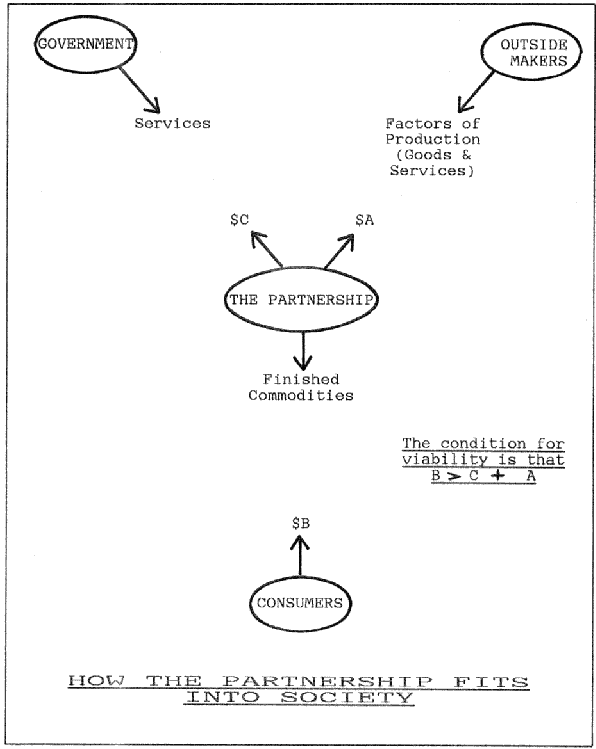

12.38 As we walked out, the economist showed us one of the charts that he had brought indicating, in a simple diagrammatic way, how The Partnership fits into the fabric of society:

From The Partnership, by Graeme Doel.

Converted to HTML by Simon Grant, 2003.